Cash Flow Statement

The cash flow statement shows the inflows and outflows of cash generated and used by an organization in a given period of time.

Examples of sources of cash:

- Sales of goods.

- Sales of services.

- Rents.

Examples of uses of cash:

- Purchase of goods.

- Wage expenses.

- Rents paid.

- Other expenses.

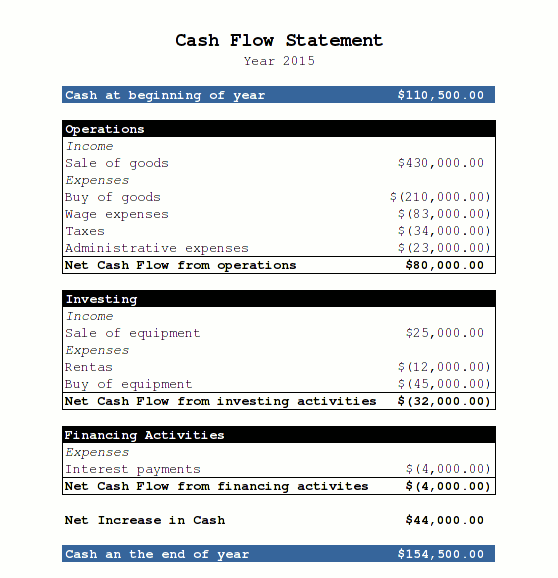

Example of cash flow:

As seen on the above example, the cash flow can be divided into 3 sections:

- Operating cash flow: cash flow from the main activities of the company (operations).

- Investing cash flow: cash flow results from the purchase or sale of capital assets, not directly related with the main activities of the company.

- Financing cash flow: cash flow results from borrowing, repaying or raising of money.

The cash flow statement is an essential statement of the short term situation of a company. It gives information about the profitability of a company and about the need of external financing.

Additionally, the cash flow statement is used to make other useful reports and indicators. For example:

- The cash flow can be used to calculate the internal return rate of the invested funds.

- The cash flows can be used to measure long term tendencies of the different components of the cash flow.

- It can be used to prevent the need of external financing.

As we can see, the cash flow statement is an essential report of every company. Is closely related with the short term solvency of a company, but is also used by manager to make strategic decisions.